When a sale is made, and tendered on Account, the GST Amount is only sent to MYOB as payments are made on the account when using the ‘Cash’ GST Accounting Basis. When utilising the cash based method, the GST activity will be noted through the ‘GST collected’ and ‘GST holdings accounts’.

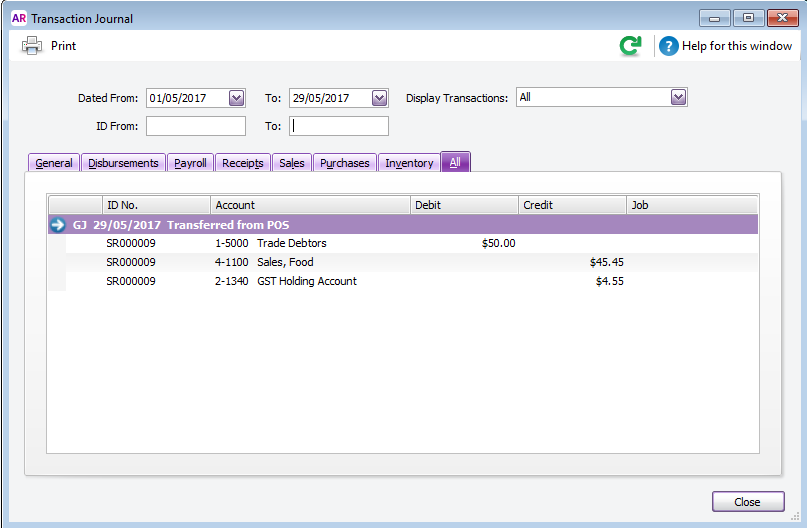

Account Sale – Cash

Sale of $50.00 Inclusive of GST and tendered on Account.

Account Payment - Cash

A full payment is made of $50.00 with the GST amount transferred from the GST Holding Account to the GST Collected Account.

Account Credit Adjustment - Cash

An Account sale of $50 Inclusive of GST with an Adjustment of $1.00 was applied to this Account to leave an outstanding balance of $49.00.

Account Debit Adjustment - Cash

An Account sale of $50 Inclusive of GST with an Adjustment of $1.00 was applied to this Account to leave an outstanding

balance of $51.00.

This can only be processed when Global Debtor not activated. As global debtor must be activated when using the cash method, this can’t be processed in this set up.